Christian R. Benard, CFP®, EA, AIF®

President, Owner, Tax Preparer, Registered Representative & Investment Adviser

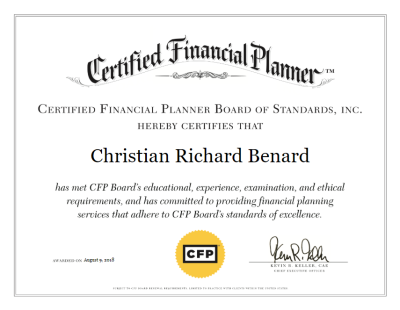

Christian Benard CFP®, EA, AIF®:

President, Owner, Tax Preparer, Registered Representative* & Investment Adviser

Education:

Walsh College Bachelor Of Business Administration – 1996

- Concentration in Finance and attended on academic scholarship and graduated with honors

Professional Experience:

C Kellian International: 1996-2006 – Owner & Partner

Innovative Financial Incorporated: 2006-Present – Founder, Owner & President

M.E. Miller & Associates: 2014-Present – Owner

Qualifications:

Series 7 – General Securities Representative

Series 66 – Investment Adviser Representative (equivalent to both Series 63 & Series 65)

Series 24 – Registered Securities Principal

Michigan Life, Accident, & Health Insurance License**

AIF® - Accredited Investment Fiduciary

Enrolled Agent, enrolled to practice before the I.R.S.***

IRS Annual Filing Season Program Participant

Personal Interests and Community Activities:

Leisure time is spent with his wife and two children, participating in martial arts where he has obtained a third degree black belt and became a ten-time international grand champion, running, investing, reading, enjoying tropical vacations and maintaining an active lifestyle.

Throughout the years he has been involved in several community activities involving Clinton River Cleanup, MS fundraising and organizing and sponsoring St. Judes Children’s Hospital events. Also a major proponent of martial arts and the discipline it provides he directed the children’s program for many years in Utica, Michigan.

Credentials:

BBA with a concentration in finance

Key presenter for Retirement Planning Today course

Licenses and Registrations:

FINRA Series 7 - General Securities Representative registration

FINRA Series 24 - General Securities Principal registration

FINRA Series 66 - Investment Adviser Representative registration (an equivalent of both the FINRA Series 63 and Series 65 securities registrations)

Michigan life, accident, and health insurance licenses

Enrolled Agent: Enrolled to practice before the IRS

*Securities offered through Commonwealth Financial Network®, Member FINRA/SIPC.

**Fixed insurance products and services are separate from and not offered through Commonwealth.

**Tax preparation and accounting services offered by Innovative Financial. Tax and Accounting services are separate and unrelated to Commonwealth.

Mark Ducharme

Accountant, Tax Preparer, Registered Representative & Investment Adviser

Mark Ducharme:

Accountant, Tax Preparer, Registered Representative* & Investment Adviser

Education:

Oakland University – Finance & Accounting – 1991 – 1994

Wayne State University – Computer Programming

Professional Experience:

Innovative Financial Incorporated: 2014-Present – Registered Representative (Commonwealth Financial Network), Accounting, & Income Tax Preparation

M.E. Miller & Associates: 1996-Present – Registered Representative (Sun America Securities, SagePoint Financial Registered Representative), Income Tax Preparation & Accounting

Qualifications:

Series 6 and 63 – Registered Representative

Series 65 – Investment Adviser Representative

IRS Registered Tax Preparer and Annual Filing Season Program Participant

*Securities offered through Commonwealth Financial Network®, Member FINRA/SIPC.

**Tax preparation and accounting services offered by Innovative Financial. Tax and Accounting services are separate and unrelated to Commonwealth.

Dennis Taylor

Accountant, Tax Preparer, Registered Representative & Investment Adviser

Dennis Taylor:

Accountant, Tax Preparer, Registered Representative* & Investment Adviser

Education:

Oakland University – Bachelor Of Science – 1986 – Major in Accounting

Professional Experience:

Innovative Financial Incorporated: 2014-Present – Registered Representative (Commonwealth Financial Network), Accounting, & Income Tax Preparation

M.E. Miller & Associates: 1988-Present – Registered Representative (Sun America Securities, SagePoint Financial Registered Representative), Income Tax Preparation & Accounting

Qualifications:

Series 6 and 63 – Registered Representative

Series 65 – Investment Adviser Representative

Enrolled Agent, enrolled to practice before the I.R.S.

*Securities offered through Commonwealth Financial Network®, Member FINRA/SIPC.

**Tax preparation and accounting services offered by Innovative Financial. Tax and Accounting services are separate and unrelated to Commonwealth.

Bridget Hockenberry

Accountant, Tax Preparer, Computer Operations

Bridget Hockenberry:

Accountant, Tax Preparer, Computer Operations

Education:

Oakland University – Bachelor Of Science – 2009 – Major in Accounting Minor in Finance

Professional Experience:

Innovative Financial Incorporated: 2005-Present – Accounting, Income Tax Preparation, & Computer Operations

Qualifications:

Enrolled Agent, enrolled to practice before the I.R.S.

IRS Annual Filing Season Program Participant

Maria Jennings

Client Service Manager, Administrative Support

Maria Jennings:

Client Service Manager, Administrative Support

Professional Experience:

Innovative Financial Incorporated: 2009-Present – Tasks include all service-related items for new and existing clients, as well as tax and accounting administrative support

Tanya Britt

Payroll Service Manager, Administrative Support

Tanya Britt:

Payroll Service Manager, Administrative Support

Professional Experience:

Innovative Financial Incorporated: 2015-Present – Tasks include all payroll-related items (tax reports/payments), as well as tax and investment administrative support

Suzanne Medina

Computer Operations, Billing Manager, Administrative Support

Suzanne Medina:

Computer Operations, Billing Manager, Administrative Support

Professional Experience:

Innovative Financial Incorporated: 2022-Present – Tasks include client database and billing operations, as well as tax and investment administrative support

Aidan Britt

Microsoft Office, Intuit, Quickbooks Specialist - Assistant: Accounting, Billing, Investment, & Tax

Aidan Britt:

Microsoft Office, Intuit, Quickbooks Specialist - Assistant: Accounting, Billing, Investment, & Tax

Education:

Oakland University: Present

- Majoring in Accounting with a minor in Finance.

- Member of the Oakland University Honors College, an exclusive program aimed towards students who exemplify hard work ethic, academic honors, and a hunger for success.

- Business Honors Direct Admit, a program limited to the highest achieving business students who must compete to be admitted into the program. This is the only standalone Business Honors Program at any university in Michigan.

- Plans to become a CPA®, CFP®, and EA

Professional Experience:

Innovative Financial Incorporated – Full Time: May 2023 – Present

Innovative Financial Incorporated – Internship: June 2022 – September 2022

Qualifications:

Microsoft Office Specialist Certifications: Excel, Word, Outlook, PowerPoint

Intuit Certifications: Bookkeeping Professional, QuickBooks User